- Scott Pape dismisses the Coalition's housing proposal

- Michael Sukkar aimed at tightening lending criteria

- EXPLORE FURTHER: Barefoot Investor advises Australians to prepare for potential cost-of-living challenges

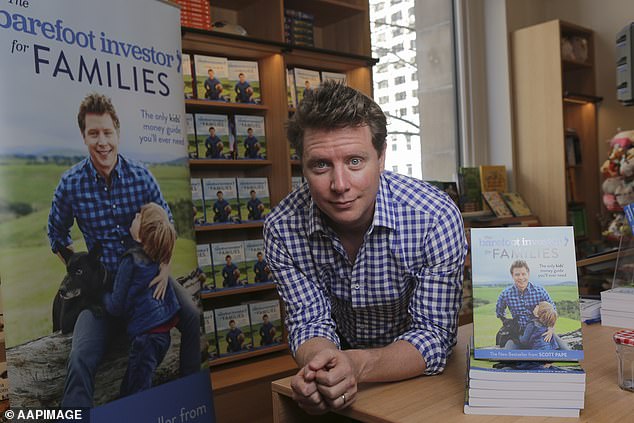

The Barefoot Investor has strongly criticized a suggestion by the Coalition to relax borrowing regulations with the aim of assisting Australians in purchasing homes, arguing that it will merely push up real estate costs.

Scott Pape stated this following an inquiry from worried tenant Penny, who reached out regarding the suggestion that was backed by the opposition party. housing minister Michael Sukkar.

"I am 32 years old, working as a teacher, and currently living with my partner who is also a teacher," she penned down.

'We’re putting in a lot of effort and cutting costs wherever possible, yet the dream of homeownership seems out of reach.' Melbourne It still seems unattainable.

'We don’t come from wealthy families with benefactors – even my mother is a renter, and my partner’s folks are still working on their mortgage.'

'I was scrolling through property updates when I came across an article citing ... the Liberals' proposals to relax borrowing regulations to assist purchasers who can’t rely on financial support from their parents. Does this have implications for folks like us, or is it merely election-season chatter?'

Mr Sukkar disclosed on Tuesday that his focus would be on the serviceability buffer for home loans should the Coalition assume power in the upcoming federal election. election .

The financial regulator – the Australian Prudential Regulation Authority – requires banks to consider home loan applicants' ability to service their mortgage at the current interest rate, plus an additional three per cent.

Previously, the buffer stood at 2.5 percent before it was increased during the Covid pandemic.

The Barefoot Investor stated that the buffer acts as a 'stress test'.

"When applying for a housing loan, the bank assesses whether you can still manage the payments even if interest rates increase," he penned in his column for NewsCorp .

'If the interest rate is 6 percent, they check if you can still manage payments at 9 percent.'

It's referred to as a 'stress test' — designed to prevent individuals from taking on more debt than they can handle when interest rates increase.

And, being a financial counselor, I believe this is a very wise policy that puts pressure on bankers.

Mr Pape mentioned that Mr Sukkar had a different perspective.

"He contends that reducing the down payment would enable first-time homebuyers to secure larger loans. This statement holds merit," he noted.

But consider this for approximately six seconds: Reducing the buffer would allow everybody to borrow more – which they surely would – and all that would accomplish is pushing house prices higher still.

Sukkar’s plan is akin to eying the last limp dim sim that has been languishing in the servo steam cabinet since last Sunday.

Penny, I understand you're hungry, but if you decide to go for whatever Sukkar is offering, ensure you've got a Hazmat suit ready, a frozen toilet paper roll, and a plumber on call.

When the statement was made, Mr Sukkar mentioned that there is an inherent prejudice supporting wealth passed down through generations.

"At present, those Aussies who can’t rely on the 'Bank of Mum and Dad' face tougher borrowing conditions — despite carrying equal or lesser risks," he stated.

'There's an inherent bias supporting inherited wealth. We'll eliminate this.'

The Coalition will not agree to a scenario where a generation of Australians lacks the same chances for homeownership as those from earlier generations enjoyed.

Read more