Statistics from the National Interagency Fire Center indicate that the amount of land scorched by wildfires is wildfires In the U.S., it seems to have risen since the 1980s, according to U.S. Environmental Protection Agency .

With the escalating destruction from wildfires due to human activities becoming increasingly prevalent, extreme weather Events, insurance firms are facing significant financial losses due to numerous claims, leading them to discontinue coverage, similar to what we observe currently. Boulder residents .

What's happening?

Insurance firms are withdrawing support from Boulder residents due to multiple factors.

Several community members had their coverage terminated because they resided in areas with a significant risk of wildfires. Meanwhile, some inhabitants of Boulder experienced premium hikes that doubled what they previously paid, leading them to question if remaining in the region made financial sense. Additionally, certain individuals were left without coverage as they owned highly valuable homes valued over one million dollars, exceeding the limits covered under typical insurance policy guidelines.

Kristina Miller Olsen, who lives in Boulder, belongs to the latter group of homeowners, with her property estimated at $3.5 million by Zillow.

Olsen expressed concern about potentially losing her home to a wildfire with inadequate insurance coverage, stating that she has a significant portion of her retirement savings tied up in their property value, according to Boulder Reporting Lab.

Stream now: Just how detrimental is a gas stove for your home’s indoor air quality?

When Olsen was let go by Nationwide because of an expensive property she owned, she managed to secure new insurance through State Farm. Nonetheless, her premium escalated dramatically, rising from $4,510 to $11,947.

Increasing expenses for home insurance are impacting property owners nationwide, including those in North Carolina , California , Florida , and Louisiana .

What makes increasing expenses for home insurance worrisome?

If climate data serves as an indicator of future events, increasing worldwide temperatures, triggered by human activities such as burning, are suggestive of what we can anticipate. dirty fossil fuels For energy — will merely result in an increase of wildfires and various other severe weather phenomena.

The heightened danger of wildfires not only endangers communities but also provides insurers with grounds to withdraw their policies from regions deemed risky, regardless of the morality involved.

|

What year was your house constructed? Fewer than a decade ago 10-25 years ago 25-50 years ago Over 50 years ago Tap on your selection to view outcomes and share your thoughts. |

Homeowners who have their coverage canceled or cannot afford the increased insurance costs might face either property loss due to fires or being forced from their homes because of financial strain.

"Rapidly, our capability to pay for our living spaces is diminishing," Olsen stated according to Boulder Reporting Lab.

What actions are being taken regarding increasing home insurance expenses?

Coloradans in charge of policy are hurrying to protect homeowners and their residences due to unsatisfactory choices made by insurance companies.

To reduce the threat of wildfires in populated areas and to attract more favorable terms from insurance providers, the proposed HB 1182 legislation mandates that insurance companies must factor in the fire prevention measures undertaken by property owners when adjusting their premium rates.

The state is establishing the Fair Access to Insurance Requirements (FAIR) Plan to offer essential protection (up to $750,000) as a final option for homeowners with high-risk properties. This plan aims to distribute the financial responsibility across leading insurance providers, ensuring that Colorado residents can secure coverage without placing an undue strain on individual insurers.

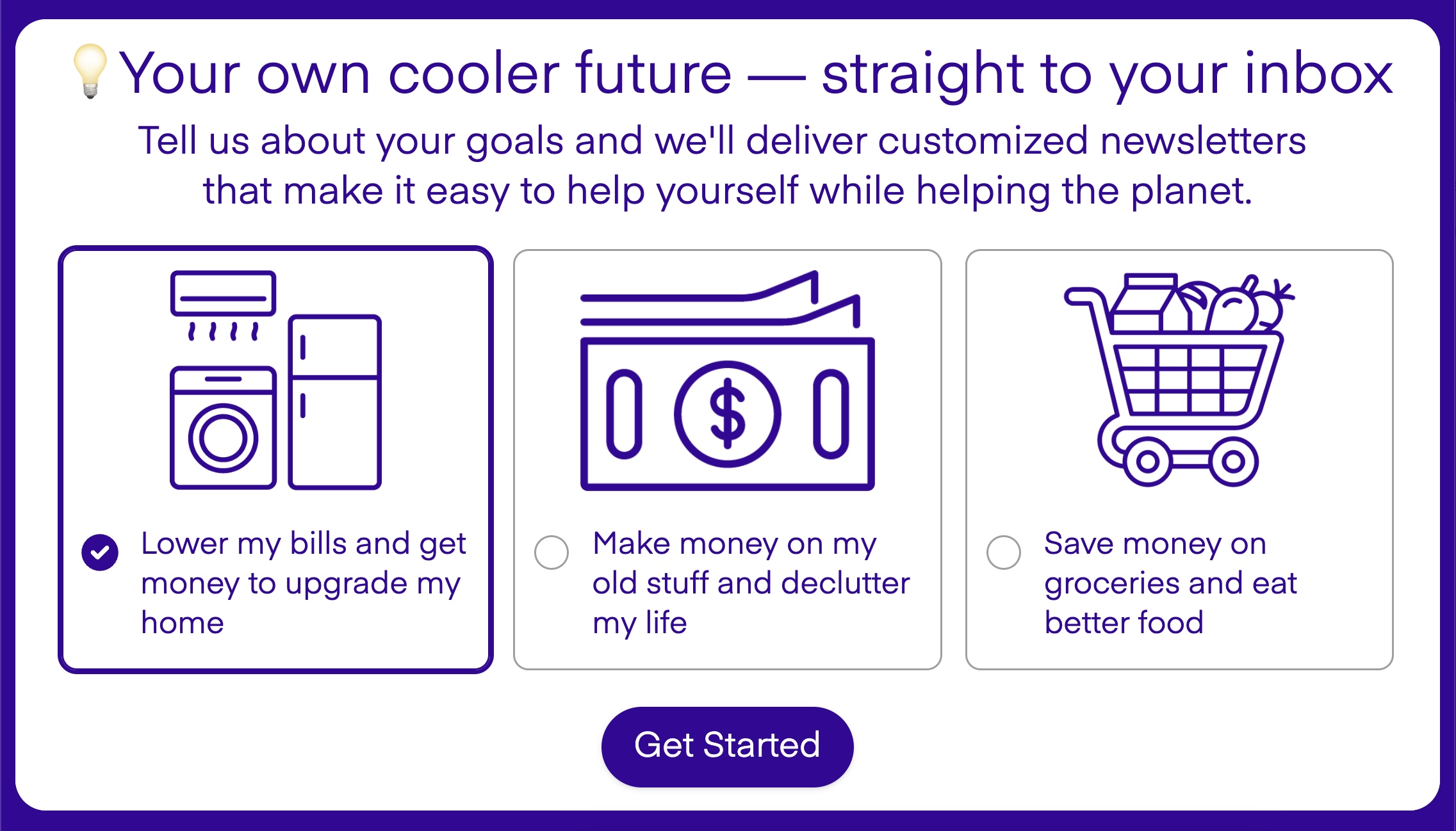

Join our free newsletter for good news and useful tips , and don't miss this cool list Here are some simple methods to assist both yourself and the Earth.

Homeowners shocked as insurers suddenly withdraw coverage: 'Our capacity to afford our homes is diminishing quickly.' first appeared on The Cool Down .