- FURTHER READING: iPhone owners allege that Apple’s iOS 18.4 has DEGRADED their device batteries

- PODCAST: Trump’s ‘Freedom Day’ Tariffs, along with an unexpected push for the death penalty in the Luigi Mangioni case. Tune into Welcome to MAGAland here.

The cost of iPhones might increase threefold. Donald Trump Analysts stated today that the new tariffs have been introduced, as Apple Fans are contemplating a boycott of the company, which has witnessed its stock prices drop significantly.

The price for a 256GB iPhone 16 Pro might rise from $1,100 (£850) up to potentially $3,500 (£2,715), experts cautioned following the President's 'Freedom Day' clampdown.

Many iPhones continue to be manufactured in China , which incurs a 54 percent tariff on U.S. exports – and Apple will now assess how much of the additional cost it can shoulder.

However, technology enthusiasts are furious about the potential price increase, with several stating it’s high time to bid farewell to iPhones and welcome Samsung 'One remarked it was Trump's clever move to promote.' Android Some suggested getting phones, while another recommended: "Simply purchase a Samsung; problem solved."

It arrives as the UK's FTSE 100 dropped to a one-year low this morning, even after Sir Keir Starmer proposing innovative initiatives to assist struggling manufacturers.

Experts have cautioned that the extent of disturbance in worldwide financial markets ranks among the most severe experienced in recent decades. This morning, during early trade in London, the FTSE index fell roughly 5 percent as a sudden selling spree began immediately following market openings.

The sense of panic spread throughout Europe, with Germany The DAX index recorded a decline of approximately 6.5 percent, and France The CAC 40 fell approximately 5.3 percent in early trading. Meanwhile, Asian equities saw broad declines, hitting fresh lows overnight.

Currently, the production cost for the iPhone is expected to rise from $580 (£450) to $850 (£660), according to TechInsights analyst Wayne Lam. The Wall Street Journal .

As many of these expenses are anticipated to be transferred to consumers, particularly in America, several Apple customers may now decide to part ways with the U.S. technology leader.

Apple sells more than 220 million iPhones a year - and its biggest markets include the US, China and Europe. However, shares of the company closed down 9.3 per cent last Thursday, losing $311 billion in market value on their worst day since March 2020.

The most affordable iPhone 16 hit the U.S. market priced at $799 (£619). However, according to estimates from Rosenblatt Securities' analysts, it might go up to $1,142 (£885) due to potential price hikes of around 43 percent – assuming Apple manages to implement these increases with customers.

An upgraded version of the iPhone 16 Pro Max, featuring a 6.9-inch screen and one terabyte of storage space, now priced at $1,599 (£1,239), might retail for close to $2,300 (£1,782) should there be a price hike of approximately 43 percent for customers.

This might also affect pricing in the UK if Apple chooses to raise the price by a similar margin in Britain—or it may opt to increment both the UK and US prices by a lesser degree.

However, Angelo Zino, an equity analyst at CFRA Research, stated that the firm would struggle to transfer more than 5 to 10 percent of the costs to customers.

He stated: "We anticipate that Apple will delay significant price increases for smartphones until this autumn, coinciding with the anticipated release of the iPhone 17, which is consistent with their usual approach to scheduled price adjustments."

If prices increase for Apple products, it might provide South Korea’s Samsung with an advantage, since Samsung operates under lower tariff rates compared to Chinese manufacturers who produce all iPhones sold in the U.S.

At present, the assembly costs about $30 in China; however, moving production to the United States would cause these expenses to increase roughly tenfold, as Mr. Lam pointed out.

Apple did not respond to the Wall Street Journal’s inquiry regarding possible price adjustments due to the recently introduced tariffs. Nevertheless, if experts’ forecasts prove accurate, these new duties suggest that the expense of purchasing an iPhone could go up.

Harry Mills, director at Oku Markets, told MailOnline: ‘Apple makes a healthy margin on iPhones, but with costs increasing by more than 50 per cent, consumers can surely expect a feedthrough straight to prices, with the top-spec iPhone 16 Pro Max possibly reaching $1,400 to $1,500.

'British customers probably won’t see savings due to a weaker U.S. dollar since the technology company maintains uniform pricing at £999 or $999 for the iPhone 16 Pro and £1,999 or $1,999 for the iPhone 16 Pro Max. Those considering upgrading their devices should consider doing so promptly to avoid potentially facing a £300 increase.'

Prem Raja, head of the trading floor at Currencies 4 You, said: ‘To mitigate such steep increases in its home market, Apple might adopt a global pricing strategy, distributing the additional costs across various regions.

‘This approach could lead to moderate price hikes in the UK and other countries, helping to maintain competitive pricing in the U.S.

‘Anticipation of these increases may prompt consumers to expedite their purchases, aiming to secure current prices before adjustments occur.

'Nevertheless, substantial increases in prices might reduce demand gradually, posing a threat to Apple’s market standing. In response, the company may have to strike a careful balance between maintaining its customer base and controlling profit margins as they navigate through these issues caused by tariffs.'

On social media, technology enthusiasts seemed prepared for the worst, as evidenced by a commenter who noted: "Apple users are about to experience what true inflation really feels like."

Another quipped: "Trump contributing to making the iPhone 16e seem like a great bargain lol."

Alarming for Apple, multiple previous customers have announced their decision not to pay the higher cost and are urging others to follow suit.

On X, a commenter proposed: 'Cease purchasing iPhones?'

'Another advised, "Stop purchasing these costly smartphones."'

A commentator added their thoughts: "Skip this purchase. There's no necessity for it. It's merely an extravagance."

One argued that the iPhone was never even worthwhile to start with.

Likewise, a technology enthusiast commented: "I'm not sure why individuals invest so much in an iPhone. An Android phone would be a better choice."

Those even considering purchasing an iPhone indicated that they would likely choose not to buy one immediately or opt to postpone upgrading to the latest model.

A prospective Apple customer commented: "I was also considering getting one. I'll need to wait and observe how everything unfolds."

'Nobody has to purchase a new iPhone annually,' added someone else.

President Trump asserts that his tariff policies will boost local manufacturing by raising the cost of imported goods.

However, because Apple would still require imported raw materials for manufacturing its devices, experts indicate that there isn’t an economically viable method to produce iPhones within the United States.

Mr. Crockett informed the Wall Street Journal that shifting iPhone manufacturing to America would be an enormous and monumental task.

'It's uncertain whether you can produce a competitively priced smartphone here,' he informed the outlet.

During his initial term as president, Mr. Trump introduced tariffs on numerous Chinese goods with the aim of compelling American businesses to relocate their production facilities either back to the United States or closer to home in places like Mexico. However, Apple managed to obtain exemptions or waivers for various items. In this instance, though, he hasn’t approved any such exceptions yet.

'Barton Crockett, an analyst at Rosenblatt Securities, stated in a note that this entire situation with tariffs on Chinese goods is unfolding quite differently from what we anticipated—specifically, that American brand Apple would receive special treatment similar to what occurred previously,' he remarked.

The iPhone 16e, introduced in February as an affordable option for accessing Apple’s range of AI functionalities, has a starting price of $599. If there were a 43 percent increase in prices, this model would soar to approximately $856. Other products from Apple might also experience similar price rises.

A lot of customers finance their phones over a span of two to three years via agreements with their mobile service providers.

Nevertheless, some experts pointed out that iPhone sales have struggled in the company’s key markets, since Apple Intelligence—a collection of tools designed to help condense notifications, compose email replies, and provide users with access to ChatGPT—has not managed to excite customers.

Experts have indicated that although the features are cutting-edge, they fail to offer sufficient incentive for consumers to upgrade to more recent versions.

The lack of growth in demand might add extra strain to Apple's profitability, particularly if expenses increase because of tariffs.

Despite some manufacturing shifting to Vietnam and India, the majority of iPhones continue to be produced in China. Both these nations faced tariffs as well, with Vietnam experiencing a 46 percent duty and India facing a rate of 26 percent.

To compensate for the additional tariffs imposed on imports, Apple would likely have to increase its prices by approximately 30 percent on average, as stated by Neil Shah, co-founder of Counterpoint Research.

'Rosenblatt Securities' Crockett pointed out that our rapid calculation indicates these tariffs announced on Trump’s Tariff Liberation Day might significantly impact Apple, possibly resulting in losses of around $40 billion for the company. He also mentioned that talks involving Apple, China, and the White House seem probable.'

'It's difficult for us to picture Trump destroying an American landmark... but this seems quite challenging.'

The top bosses of tech companies in Silicon Valley rallied behind Donald Trump as he approached his electoral win, encouraged by his pledges to reduce regulations and tax rates.

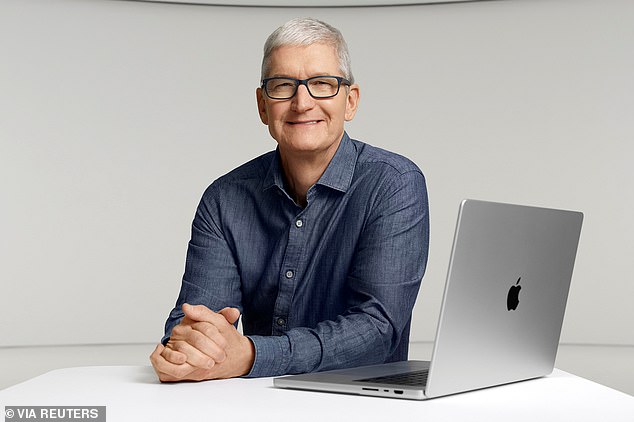

Jeff Bezos, chairperson of Amazon; Mark Zuckerberg, CEO of Meta; Tim Cook, head of Apple; and Sundar Pichai from Alphabet were present at Trump’s inaugural event in January, openly showing their support for the president.

Both Meta and Amazon contributed $1 million each to President Donald Trump's inaugural festivities, with Apple CEO Tim Cook also donating an additional $1 million individually.

However, the affection has faded since Trump announced extensive tariffs last week, causing billions of dollars to be erased from the market value of technology companies' shares.

Russ Shaw of Tech London Supporters mentioned, "It was initially an unusual friendship to start with, I believe it was driven by mutual opportunities on both ends."

'Biden didn’t reach out to the tech giants, allowing Trump to capitalize on this. The harsh truth is now becoming clear.'

Especially hard-hit by the aftermath was Apple.

Trump imposed crushing tariffs not only on China, where the majority of Apple's iPhones are made, but also on countries such as Vietnam and India, where Cook has quietly moved parts of its production in recent years in anticipation of further Chinese tensions.

In Vietnam, where Apple currently produces AirPods, iPads, and Apple Watches, the country experienced one of the most significant impacts, with a new tariff rate of 46 percent. Meanwhile, India faces a tariff rate of 26 percent.

Trump's tariffs could lead to the price of an iPhone rising by up to 43 per cent, meaning the most expensive iPhone would cost $2300, up from $1599 today.

Mr. Shaw commented, "This issue is especially severe for companies producing hardware such as Apple. They depend on global supply chains to manufacture devices like smartphones and PCs."

Last week, Treasury Secretary Scott Bessent stated that a downturn in the markets indicated that investors were adjusting after several months of excessive enthusiasm for artificial intelligence and inflated technology stock prices. He referred to this as a 'Mag 7 issue, not a MAGA issue,' alluding to the group known as the 'Magnificent Seven' tech companies: Apple, Amazon, Tesla, Alphabet, Microsoft, Meta, and NVIDIA, which specializes in chips.

On Liberation Day, Mr. Trump announced that international trade and economic policies had triggered a state of national emergency.

Every country will encounter a minimum of 10 percent tariffs on all imports from the United States beginning this Saturday.

However, over 90 nations will face extra retaliatory tariffs aimed at rejuvenating America’s wealth by April 9.

According to the White House, reciprocal tariffs represent the levels needed to counterbalance the trade imbalances between the United States and every one of its trading partners.

Various nations such as China will face these tailored taxes, with the calculations made by the White House taking into account each country’s trade policies.

Following Mr. Trump’s declaration of Liberation Day, Chinese President Xi Jinping announced that China would impose an extra 34 percent tariff on all goods imported from the United States.

The fresh duty, set to begin on April 10, mirrors the 'reciprocal' 34 percent charge enforced by Trump. These additional duties will be added to the current tariffs that have been placed on American products.

Craig Singleton, a senior China fellow at the Foundation for Defense of Democracies, stated to the Associated Press that although China’s new tariffs do not initiate an all-out trade war, they represent a significant intensification. These measures mirror each retaliatory move from Trump, indicating that President Xi Jinping will not remain passive amid such pressures.

Before Wednesday’s announcement, Mr. Trump had previously imposed two sets of 10 percent import tariffs on China.

Mr. Singleton cautioned, 'The more prolonged this situation gets, the tougher it becomes for both parties to ease tensions without suffering loss of prestige.'

Read more