- PODCAST: An in-depth look at the controversy surrounding the war plans group chat, along with Trump’s dislike of his new portrait – all on Welcome to MAGAland. Tune in now.

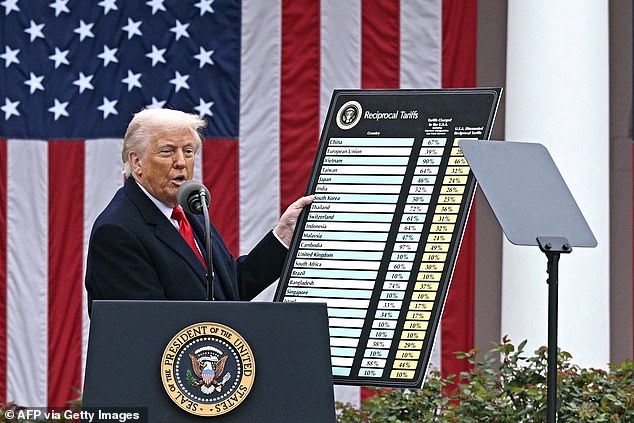

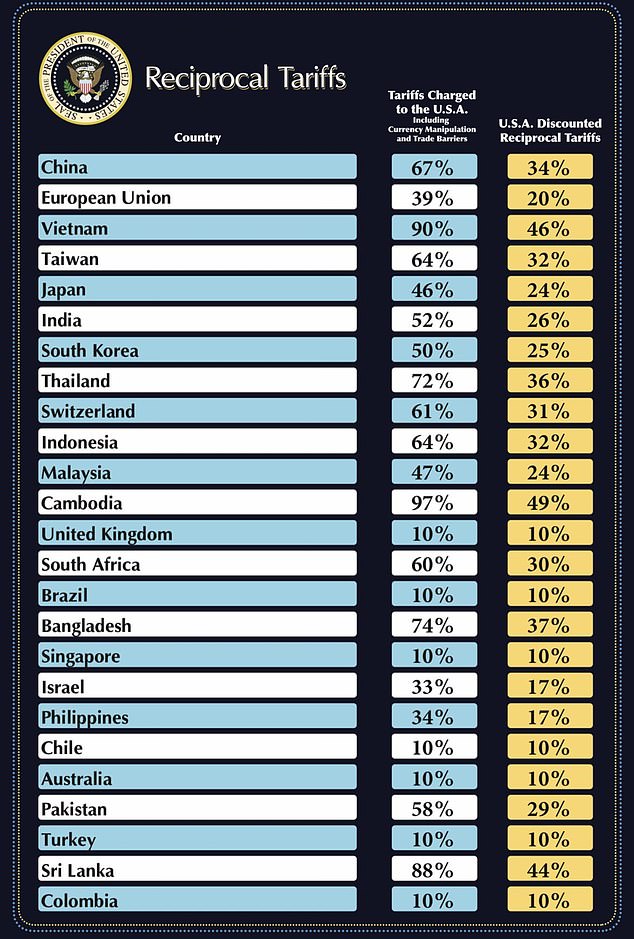

US president Donald Trump Yesterday evening imposed a 10% duty on nearly all UK-imported products as part of widespread tariff implementations targeting nations globally.

Britain appeared to come out the least unscathed in the Republican's so-called Liberation Day announcements. Many nations saw tariffs of up to 49% slapped on them.

However, experts warn that it will remain a challenging journey for the British people as global communities adjust to the effects of the Liberation Day tariffs.

Clarissa Hahn, who works as an economist at Oxford Economics, stated to the BBC Although the first surge in prices will primarily affect American consumers, UK residents might subsequently experience comparable hikes.

This could be attributed to the possible volatility of the pound, along with unpredictable exchange rates against other currencies following Trump's statements.

Even though this implies that costs might rise or fall, British citizens will ultimately notice the impact in their bank balances as price variations are transferred to customers through companies that initially bear the tax burden.

If prices increase, Ahmet Ihsan Kaya, the lead economist at the National Institute of Economic and Social Research, informed the media outlet that this could potentially 'lead employees to request increased compensation.'

She noted that if the UK chose to engage in a trade war with the US as a reaction to these tariffs, it could lead to an increase in consumer prices.

Up until now, Sir Keir Starmer's administration has promised to maintain composure when dealing with tax issues.

Jonathan Reynolds, the business secretary, commented after the announcement of the tariffs: "No one desires a trade war, and we still aim to reach an agreement. Nevertheless, all options remain under consideration, and the government will take every measure needed to protect the nation's interests."

However, aside from the concern over consumer prices, experts cautioned that British employment could also be impacted.

The United Kingdom presently exports approximately £60 billion worth of products to the United States.

Nearly all of these items will now incur a 10% tax for shipment to the US, increasing their cost.

Within this £60 billion, British automobiles account for just over £6 billion of the exports. Yesterday evening, Trump declared a 25% tariff on all imported vehicles, once more increasing costs and reducing appeal for purchasing British-manufactured cars.

The think tank Institute for Public Policy Research stated that the tariff is 25%. threatens 25,000 British jobs with potential cuts As one out of every eight vehicles manufactured in the UK is exported to the United States.

The think tank warned that it's not only automotive jobs that could be threatened; pharmaceutical positions might also be in danger.

UK-based pharmaceutical companies AstraZeneca and GSK derive approximately 40% and 50% of their revenue from the United States, respectively.

Despite having production facilities in the United States, they still depend on importing raw materials from the UK and the European Union. This imports process has unfortunately faced a 20% tariff increase.

Experts indicated that all these factors are poised to influence interest rates for British individuals.

High-interest rates, which dictate how much everyday individuals must pay when taking out mortgages, home equity loans, and credit card debt, can serve as an advantage for savers but pose significant challenges for borrowers in need of funds.

At present, standing at 4.5%, economists predict that there will likely be two additional interest rate reductions before the year ends.

However, last month, the Bank of England stated that it would not reduce interest rates due to 'heightened' economic uncertainty. caused by Donald Trump's upturning of the economic order .

Following the tariff announcements that created significant doubt in the financial markets shortly after they were made, interest rates might remain at 4.5% or potentially increase further.

Andrew Bailey, the Bank of England governor, earlier said it was the institution's job 'to make sure that inflation stays low and stable' and that would be ' examining thoroughly the effect of tariffs .

Read more