PETALLING JAYA: While the US imposing tariffs may seem gloomy, it actually presents an opportunity for our country, according to various trade associations.

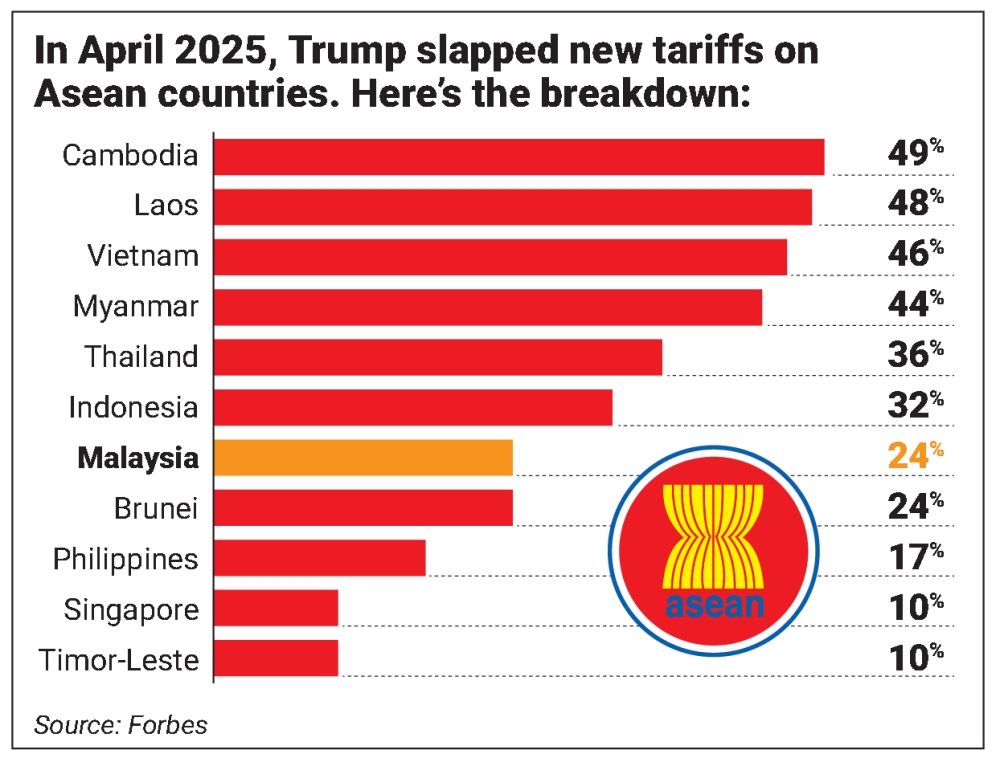

The President of the Federation of Malaysian Manufacturers, Tan Sri Soh Thian Lai, stated that although the 24% tariff imposed on Malaysia is far from perfect, it offers certain strategic benefits when compared with neighboring countries.

numerous ASEAN nations such as Vietnam, Cambodia, and Laos along with China are encountering substantially increased bilateral US tariffs, with some approaching twice the rate imposed on Malaysia.

This change effectively flattens the competition landscape and places Malaysia in a more appealing position for exports, particularly for purchasers looking to move away from pricier nations.

"We can leverage this competitive edge to grab a portion of the U.S. market in specific product segments," he stated upon being reached for comment.

Although sectors such as semiconductors and pharmaceuticals are not subject to the tariff increase, Soh mentioned that other industries could still see advantages.

They encompass items such as rubber gloves, electronic gadgets, packaged foods, aviation parts, furniture, and medical equipment.

"These sectors are areas where Malaysia has demonstrated expertise, and where rival suppliers from China or Vietnam currently encounter increased tariff obstacles," he stated.

Soh observed that Malaysia's robust manufacturing capabilities, varied supply chain network, and credible regulations could establish the country as a dependable alternative within global supply chains catering to the U.S. market.

The Associated Chinese Chambers of Commerce and Industry Malaysia Treasurer-General, Datuk Koong Lin Loong, stated that imposing elevated tariffs on other countries within the Southeast Asian region might result in substantial long-term benefits for Malaysia.

The bright side we should focus on is the possibility of turning Malaysia into a key regional investment center.

"Investors prefer putting their money here over countries like China and Vietnam, where they faced heavier tariffs," he stated.

He mentioned that the country's attractiveness as an investment destination was enhanced because of its robust economy, consistent governmental policies, and capable workforce.

These are key elements that investors take into account.

“Although the US tariffs on the Philippines (17%) and Singapore (10%) are lower than Malaysia, investors may find policies in the Philippines not so conducive while Singapore may be too expensive for them to set up operations,” he said.

Koong mentioned that the strengthening of the ringgit against the US dollar can be attributed to robust economic indicators within the country and the currency being considered undervalued.

Given the imposed tariffs, fund managers view the currency’s potential.

"Additionally, our stock market has stayed above the 1,500 level, unlike some others that experienced significant drops," he noted.

The President of the SME Association of Malaysia, Chin Chee Seong, stated that these tariffs will affect certain areas but primarily target particular high-tech and premium petroleum goods rather than across all sectors like in various other nations within the Asia-Pacific area.

Relative to several nations like Laos, Cambodia, Vietnam, and China, our situation remains comparatively more favorable.

We primarily export advanced technology goods and premium petroleum products, constituting the major portion of our transactions with the United States; concurrently, we maintain a comparatively modest trade imbalance.

"We are in a more favorable situation since items like semiconductors are not subject to tariffs. Therefore, we will probably face only a 10% tariff on most of our other exported goods," he stated when reached for comment.

Chin observed that Malaysia was heading in the correct direction by avoiding retaliatory actions towards the United States and choosing instead to pursue a policy of friendly interaction.

He thought that US President Donald Trump might experience another phase of tariff modifications because of the criticism he is receiving from various nations as well as within his own country.

The co-chairman of the Asean-India Business Council, Nivas Ragavan, noted that Malaysia avoided increased tariffs thanks to its equitable trading relationship with the United States, especially in critical sectors like electrical and electronic products, medical equipment, and precise components which demand stringent compliance standards.

"These sectors are closely intertwined with U.S. supply chains and follow international regulatory standards, which might have led the United States to apply a lesser tariff rate than other regional exporters who have distinct trade profiles," he explained.

Nivas, who also serves as the vice-chairman of the Federation of Malaysian Businesses Association, stated that reducing tariffs for Malaysia would offer the country a stronger competitive edge.

Many of our ASEAN neighbors now encounter higher expenses when exporting goods to the United States.

"This might steer specific American purchasers and investors towards Malaysia, notably within areas such as manufacturing, electronics, and medical equipment," he stated.

He mentioned that the nation could utilize its current free trade pacts and business-conducive atmosphere to draw in shifts in supply chains from nations with higher tariffs.

"There's an opening here for Malaysian exporters to seize, innovate, and take over the space vacated by their regional rivals," he noted.

As for the ringgit’s recent appreciation, Nivas said that this could be due to the volatility of the US economy due to inflationary pressure.

"In the Malaysian context, persistent trade surpluses, higher commodity prices especially for palm oil and energy, along with a gradual rebound in local consumption, are bolstering faith in the ringgit," he further stated.

The advisor of Bumiputera Retailers Organization Malaysia, Datuk Ameer Ali Mydin, stated that products brought in from nations facing increased tariffs might ultimately be sold in this country for less money.

This is because companies in those impacted nations might produce more than needed domestically as a result of increased taxes on exports to the United States.

"Nevertheless, we need to be cautious about avoiding dumping from these nations, which is currently occurring via e-commerce platforms and could impact our retail industry," he stated.