Due to his impressively robust history of success, investors view Warren Buffett as a role model for investment regardless of market conditions. Serving as chairman, he has played a key leadership role. Berkshire Hathaway to a compound annual growth rate of almost 20% over 59 years, as opposed to the compound increase of roughly 10% for the S&P 500 . Therefore, Buffett has undoubtedly demonstrated his prowess as an exceptional investor.

That’s precisely why investors might pay even closer attention to what this major investor says during periods of market distress. Buffett started signaling his concerns to Wall Street last year as he decreased stakes in previously preferred stocks. Apple and Bank of America , concluded open positions in index funds Monitoring the S&P 500, they accumulated an all-time high amount of cash. This indicated hesitance during a bullish market that kept surging upwards.

Start Your Mornings Smarter! Wake up with Breakfast news In your inbox each trading day. Register for Free »

Over the past several weeks, investors have grown concerned about underwhelming economic statistics and the effects of various challenges. President Donald Trump's tariffs Regarding the economy and corporate profits, indices lost their upward trajectory. Nasdaq And the S&P 500 fell into correction territory, declining over 10% from their latest highs. In this chaos, Buffett’s warnings to Wall Street became notably stronger. Let's look at what Buffett advised and how we should proceed with the ongoing market correction.

Buffett's recent moves

Firstly, let’s delve into some background about Buffett and his latest strategies. Often referred to as the Oracle of Omaha, he has earned acclaim for picking high-quality stocks selling at fair or discounted rates with an eye toward long-term gains. An exemplary instance would be Coca-Cola , which he purchased when it was valued at approximately 15 times its earnings in the late 1980s — and Buffett continues to retain this stock even now.

The wealthy individual does not get influenced by current fads and thus feels no hesitation about opposing popular opinion. Actually, he previously stated in a letter to shareholders that both he and his team aim “to act with caution when others are overly confident and to show enthusiasm solely when others are wary.” This approach, as noted earlier, has resulted in superior returns compared to the overall market over an extended period.

Consistent with his habit of diverging from popular opinion, as stock prices surged last year, Buffett became a net seller — amassing total net sales of $134 billion. This significantly boosted Berkshire Hathaway’s cash reserves to over $334 billion. Although Buffett has not disclosed his motivations behind these transactions, a major reason driving his decisions might be the prevailing market trends. valuations , as stock valuations reach all-time high levels.

A phenomenon that has occurred merely two times previously

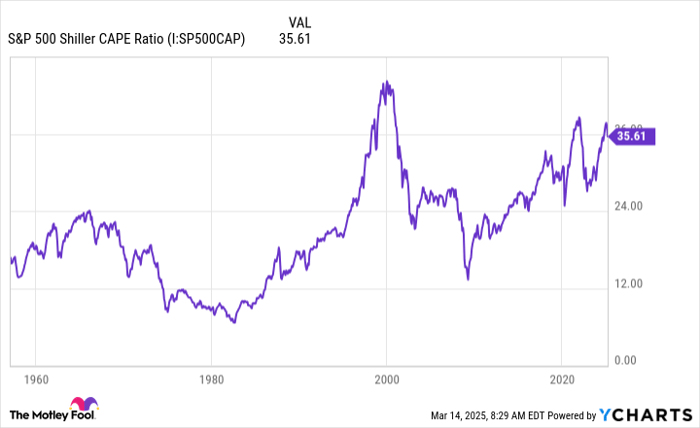

The The S&P 500 Shiller CAPE ratio (cyclically adjusted price-to-earnings ratio) went past the threshold of 37, a level it has surpassed only two times since the benchmark was established with a roster of 500 companies. This indicator is notably significant as it evaluates both stock prices and earnings per share across a decade, thus accounting for economic shifts. Clearly, equities were becoming costly; hence, it’s plausible that the value-focused investor Buffett took this into account when making his investment choices.

Buffett's actions in the previous year might have served as an early alert to Wall Street, however, a recent statement from the leading investor seems to amplify this cautionary signal. even louder It pertains to President Trump's actions. tariffs The Trump administration first introduced tariffs on numerous imported products from China, Canada, and Mexico. This policy was later expanded to encompass aluminum and steel imports from all countries.

These concerns led investors to become uneasy. Consequently, at the beginning of this month, the Nasdaq dropped from its peak set on December 16th, and the S&P 500 also retreated last week after hitting a high point on February 19th. By the end of the previous week, both indexes were considered to be in correction territory.

"An act of war"

During an interview with CBS last week, Buffett referred to the tariffs as "a declaration of war," warning that this could result in increased expenses for consumers. He emphasized the importance of considering "what next?" concerning who would bear these additional costs. Although Buffett did not provide more specifics, his comments imply that the tariffs might pose challenges for businesses and economic growth.

So, does this imply that Buffett is fleeing the market And you might want to follow suit? It’s not a must. Adhering to his standard investment approach, Buffett remained wary last year when stock valuations climbed significantly and continues to monitor the trade tariffs closely at present. However, as a committed long-term investor, Buffett has consistently purchased equities throughout various market conditions, which has turned out to be a successful tactic for him.

The main point is to concentrate on the valuation of each specific stock along with the company’s future potential. Current tariffs might pose difficulties in the short run, yet if a firm can handle these circumstances and has a robust long-term growth outlook, this could be an opportune moment to invest as the stock price drops.

Despite not heavily investing in stocks throughout the previous year, Buffett managed to identify some prospects and initiated a new stake. Constellation Brands and increasing shareholdings Domino's Pizza In the most recent quarter, for instance. This indicates that, during the corrections in the S&P 500 and Nasdaq, the following step should be look for opportunities -- high-quality players being traded for very low prices -- snap them up, and like Buffett , hang tight for the long haul.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on purchasing the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for growth. Should you fear missing out on potential opportunities, this might be an ideal moment to purchase stocks before it becomes too late. The figures clearly indicate as much.

- Nvidia: If you had put in $1,000 when we increased our investment in 2009, you’d have $315,521 !*

- Apple: If you had invested $1,000 when we increased our stake in 2008, you’d have $40,476 !*

- Netflix: If you had invested $1,000 when we increased our stake in 2004, you’d have $495,070 !*

Currently, we're sending out "Double Down" alerts for three amazing firms, and such an opportunity might not come around again anytime soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Bank of America serves as an advertising sponsor for Motley Fool Money. Adria Cimino does not hold any shares in the aforementioned stocks. However, The Motley Fool holds stakes in and endorses Apple, Bank of America, Berkshire Hathaway, and Domino's Pizza. Additionally, they recommend stock in Constellation Brands. The Motley Fool owns shares in these companies as well. disclosure policy .