Certain brands resemble Teflon. Regardless of making repeated marketing blunders or irritating their customer base, scandals do not cling to them, and they continue as usual.

Apple, Amazon, Lego, Starbucks, and Coca-Cola are among several corporations that have faced considerable criticism or unfavorable consumer comments; however, they continue to thrive despite these challenges.

Don’t overlook the opportunity: JOIN Diwita.News | for their FREE daily newsletter!

A different label, widely adored by women across the globe, has previously experienced considerable criticism as well.

Related: Well-known retail chain shutting down stores across the country (specific locations disclosed)

Throughout the years, Victoria's Secret, a globally renowned brand, has encountered criticism ranging from insufficient size inclusivity to overly sexualized advertising campaigns. The company has also been accused of mistreating both staff members and models through acts of bullying.

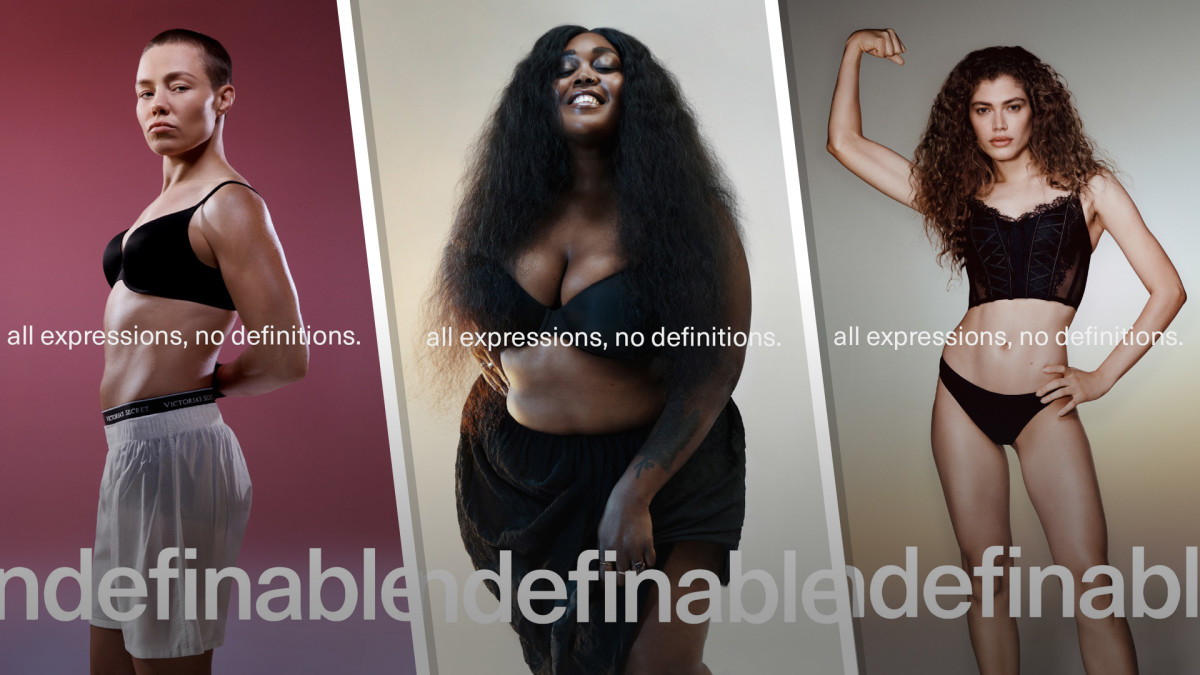

More recently, Victoria's Secret has made moves to repair some of the damage. The company has gone so far as to rebrand itself by featuring plus-size and transgender models in advertising and by vastly expanding its size offerings.

Related: Trader Joe's, Aldi make surprising moves in grocery space

In recent years, as Victoria's Secret attempted to attract a wider customer base, the true rivalry for both women’s affections and spending began in the late 2010s. It was during this time that large retailers such as Target and Walmart enhanced the quality and selection of their bra and undergarment lines, providing these items at more competitive price points to consumers.

For instance, Target offers a six-pack of its well-liked Auden line of bikini undergarments for $12. In contrast, at Victoria's Secret, a solitary pair of standard bikini underwear costs $10.50, or you can get a five-pack for $30.

Nevertheless, Victoria's Secret has been striving for a revival, including reinstating its renowned runway fashion show in 2024, following a six-year hiatus.

Despite store closings, Victoria's Secret anticipates steady growth.

From 2020 to 2023, Victoria's Secret shut down over 300 of their retail locations.

It is reported that more closings will occur in 2025.

Based on the retailer's latest information recent financials The firm anticipates roughly 30 to 40 store closings in 2025, primarily involving the consolidation of adjacent Victoria's Secret and PINK outlets.

Meanwhile, the firm intends to refurbish roughly 45 outlets.

In the company's latest earnings call, CEO Hillary Super stated, "I am satisfied with the performance during our fourth-quarter holidays, as we witnessed an increase in sales across both our Victoria’s Secret and PINK lines, along with our prominent Beauty division."

Further insights into retail and bankruptcy:

- Walmart store closing, auctioning off laptops and flat screen TVs

- Home Depot CEO raises concerns about an escalating issue

- Well-known eatery seeks Chapter 11 bankruptcy protection

She observed growth in sales for most key product lines, both in physical outlets and online platforms, as well as within the firm’s operations in North America and overseas markets.

"As we look forward to 2025 and the future, we recognize there are near-term headwinds and ongoing uncertainty in the macro environment which we will manage aggressively while also working to build upon our solid foundation, realize the full potential of our brands and drive long-term, sustainable growth," Super said.

In August 2024, Super assumed control of the company, and during her tenure, third-quarter sales increased by 6.5%, reaching $1.3 billion compared to the prior year. This marked the firm’s most substantial quarterly expansion in three years.

Related: Seasoned fund manager reveals striking prediction for the S&P 500