Ever since I joined Livewire, one of the frequent queries I've received from acquaintances and relatives is, "Is this a good time to purchase real estate?" Regardless of whether it’s their primary residence or an investment property, buying a house is a significant choice.

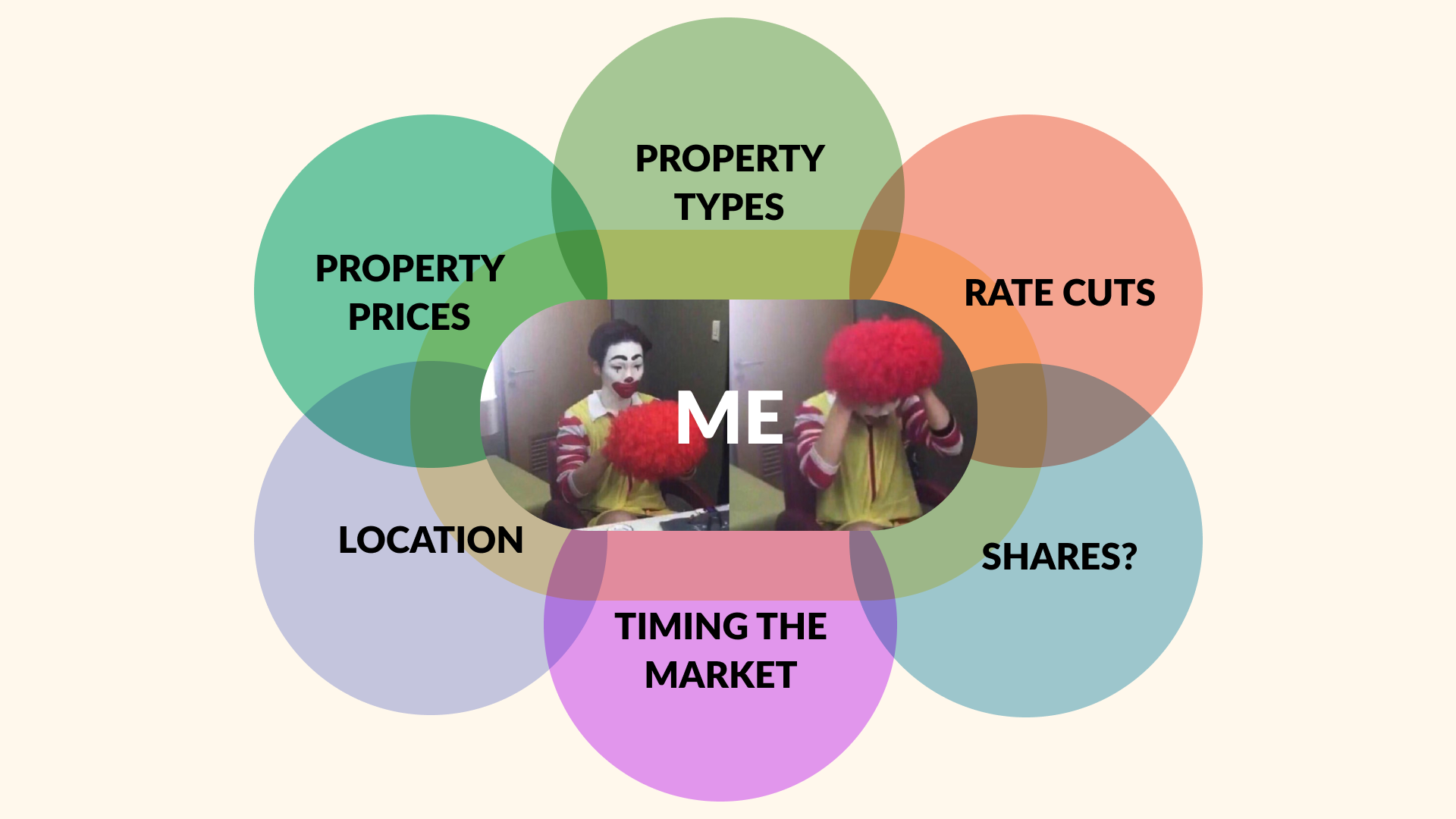

To evaluate whether it’s better to purchase now or wait, I consulted several industry professionals who helped break down and address this significant question by examining the following aspects:

- Market timing

- Affordability

- Price outlook

- Property types

- Geographic insights

1. Market Timing

Based on insights from real estate market analysts, Cameron Kusher The recently implemented interest rate reduction has brought stability to the real estate sector, notably in Sydney and Melbourne, where modest price increases have started to occur. Moving forward, he anticipates additional decreases in interest rates will quicken this pace.

If you can make your purchase now with ample inventory available and less competition from other buyers, even before interest rates decrease further, this approach likely makes the most sense.

Nathan Smith , mortgage broker and director of Birdie Wealth, notes that many prospective buyers have been sitting on the sidelines for the past 18 months, waiting for the right moment to enter the market.

“The rate cut was certainly that sign, and we have seen a flood of buyers enter back into the market.”

Despite ongoing global economic instability, Melinda Jennison, The president of REBAA and a buyers' agent notes that Australia's real estate market is distinctly influenced by robust population expansion and a considerable shortage of newly constructed homes.

Evan Thornley The co-founder and CEO of Longview Property Management also concurs that the primary factor behind rising house prices is population growth. He underscores that "essentially, what you purchase is far more significant than the timing of your purchase."

If you secure a significant piece of property—a 'RODWELL' (Robust Older Dwelling on Well-Located Land)—its value could readily increase twofold within a decade, even if bought amid a minor market uptick.

He adds further, "'In the meantime, an average property (such as a gleaming modern skyscraper flat) might not provide significant capital appreciation, regardless of how 'inexpensive' it appears at present.' He then explains that shifts in the trend of interest rates have a far stronger impact — driving purchasers to attempt outpacing future price hikes and sellers to delay listing their properties — which leads to a mismatch between supply and demand, consequently propelling prices higher."

The agreement is evident — accurately predicting the market at the perfect time is almost unachievable, and present circumstances benefit those prepared to act immediately. This counts as a point in favor of taking action now.

2. Affordability

As soon as it was evident that rate increases had stopped, consumer confidence rose, and the sentiment got an additional uplift with the reduction of rates. This underscores the high sensitivity of Australian families to alterations in interest rates.

"Additional decreases in interest rates would boost borrowing ability—with every 25-basis-point adjustment, this capability can go up by approximately 2% to 2.5%. As individuals have greater access to loans and an increasing number of potential purchasers enter the market, we anticipate improved confidence leading to higher property values," explains Kusher.

He points out that the crucial question is whether increasing costs will negate these improvements in affordability. At present, he feels this outcome is improbable.

Conversely, Jennison cautions about the possible drawbacks:

“Lower interest rates tend to lift buyer sentiment and increase borrowing capacity, making people feel more comfortable taking on debt. However, this can lead to increased demand, especially in supply-constrained markets, which can push prices higher and paradoxically worsen affordability over time.”

Smith highlights that present borrowing criteria involve substantial cushions, with applicants evaluated based on their capacity to manage loan payments at interest rates above 9%. Nevertheless, reduced interest rates might substantially alter purchase feasibility for numerous potential homebuyers.

A single or double interest rate reduction could boost their financial capability by anywhere from $30,000 to $100,000, which would definitely provide them with the opportunity to purchase their ideal house.

This rise in borrowing capacity might indicate that individuals who were once unable to afford the market may now actually get a opportunity to purchase.

Thornley offers an additional viewpoint: although interest rates significantly affect borrowers with substantial mortgages—primarily first-time homeowners—in contrast, those upgrading properties valued at over $1.5 million generally depend more on their accumulated equity. This implies that these purchasers' capacity to buy new homes hinges more on the appreciation of their present property’s value rather than minor fluctuations in interest rates.

Overall, this seems to be yet another advantage of purchasing now – as lower interest rates will boost lending ability and likely raise property values.

3. Forecasted prices for 2025

Therefore, what’s the approach to stay ahead of market indicators? Kushner highlights the significance of monitoring key economic factors such as clearance rates and property prices, alongside the quantity of listings and the speed at which homes are being sold.

Smith points out the significant demand from purchasers, especially in Sydney, who have been awaiting the ideal moment to buy.

We view 2025 as the chance for them to seize this opportunity. There has been a rise in inquiries regarding pre-approvals and from first-time buyers, leading us to anticipate that this will boost demand, resulting in higher property values.

Jennison predicts that property markets characterized by limited availability and comparatively higher affordability, where local purchasers aren’t overly strained financially, stand a greater chance of experiencing steady value increases.

Thornley is straightforward: "Forecasting home values is an unwise pursuit... nonetheless, present signs point towards modest increases with variations between cities. Regardless, it's essential to concentrate on the fundamental aspects of a particular property over the long term."

Once more, it’s about WHAT you purchase (a quality single property) rather than WHEN you purchase it (attempting to predict the market – including city trends).

Even though there are some drawbacks, this seems to add another point in the "pro" column.

Given the information presented earlier, it appears that purchasing a property at this juncture might be advisable if you possess the means to do so. However, everyone understands that deciding to buy is merely part of the solution. Several additional elements come into consideration here.

4. Property types

Kusher thinks that although reduced interest rates will be advantageous for various kinds of properties, homes—especially those in more expensive regions—are likely to experience the most significant increases in value. This is due to the longstanding preference among individuals to purchase a house over other forms of real estate.

Instead of concentrating on particular kinds of properties, Smith highlights the significance of grasping local demand. He points out that various regions have distinct requirements when it comes to real estate.

When discussing different property categories, it often boils down to the dynamics of supply and demand. The number of homes available is restricted, while numerous families urgently aspire to enter this sector.

I believe that standalone houses and bigger townhomes for those looking to downsize will consistently see high demand," he states. He points out that people buying in regional areas often value more space, whereas purchasers in urban centers might lean towards apartment living.

Thornley further notes that large apartment complexes frequently sell based on stamp duty concessions or tax deductions for wear and tear rather than their potential as solid investments. "The cost of construction has skyrocketed, and the value of the land in these tower blocks is minimal, which means limited opportunities for appreciation. It’s best to steer clear of them. Additionally, student housing will likely face challenges due to decreases in international student numbers, and many cannot secure financing since they typically fall under 40 square meters, thus offering little room for significant gains," he explains.

In conclusion, the sector that consistently excels is the one that capitalizes on true land shortage.

Jennison also notes that no particular property type excels in every market since their performance differs based on location.

There isn't a universal solution because understanding the specific local markets is crucial. The real estate landscape varies across different regions of Australia.

5. Geographic insights

In 2024, the Australian real estate landscape presented contrasting scenarios: cities like Sydney, Melbourne, Hobart, and Canberra saw modest increases, whereas Brisbane, Adelaide, and Perth witnessed substantial price hikes reaching into double digits. As we look ahead to 2025, Kusher anticipates that Brisbane, Adelaide, and Perth will maintain their strong performance, primarily due to constrained availability which sustains high pricing in those regions.

There’s a high chance they will continue to outshine other markets primarily due to the limited supply of properties currently up for sale.

Smith observes a change in focus among real estate experts and purchasers, showing heightened interest in Sydney and especially Melbourne. Jennison suggests that although alterations in nationwide interest rates affect every city, localized economic elements like employment expansion, construction initiatives, and residential availability play a more crucial role in determining price fluctuations.

We might still witness a two-tiered market dynamic in 2025.

She reinforces the view that both Brisbane and Adelaide will keep up their pace:

Brisbane, specifically, is drawing more focus because of the 2032 Olympics and the accompanying surge in infrastructure development. Despite some recent lagging performance, Melbourne might see a resurgence; however, governmental policies and supply factors continue to pose challenges.

Thornley also points out that all urban marketplaces operate in cycles, with local elements being the primary influencers on geographical demand. He mentions that many rural regions experienced significant growth during the pandemic period when numerous remote employees moved into these locations (take Byron Bay for instance). However, certain rural zones now confront potential risks since workers are returning to metropolitan centers. Additionally, their economic stability often relies significantly on specific industries such as farming, mining, or hospitality. Should these key sectors encounter difficulties, this could lead to fluctuations in real estate prices.

“ If you truly comprehend those local factors, sticking with the major cities along the eastern seaboard—such as Sydney, Melbourne, and Brisbane—is still your safest choice. These locations see rising property values due to their varied economic activities and increasing populations over time.”

Is it about finding the perfect timing, or securing the ideal property?

As the old saying goes, the ideal moment to invest in real estate was two decades ago. However, it genuinely appears that the second-best time would be right now.

As interest rates decline, borrowing capabilities increase, and a market previously skewed by lack of supply is poised to reach balance (or possibly overcorrect), this appears to be an opportune moment for buyers that may not present itself again anytime soon.

It might seem unusual to mention this, especially considering that national home values have reached an all-time high, yet for individuals with certain adaptability, whether it be regarding the kind of property or location, there are still numerous choices available.

Therefore, conduct thorough research, understand your target market, and concentrate on prime locations with superior quality assets. Everything else is essentially beyond your influence.

Are you considering purchasing a property this year? Share your thoughts in the section for comments down below.

Top Trending on Livewire Markets

- What experienced investors do during downturns in growth stocks (along with 7 firms and ETFs they’re purchasing currently)

- "The market's inefficiency presents our opportunity": Magellan's 3 high-quality stock selections for these uncertain periods

- Why investors don’t have to—and currently shouldn’t—own gold