Several technologies have garnered significant market interest in recent years, but none has been as captivating as artificial intelligence (AI). This isn’t surprising, considering the immense potential this technology holds—potential highlighted by industry leaders such as Sam Altman (the CEO of OpenAI) and Dario Amodei (the CEO of Anthropic), who envision a near-future where their innovations revolutionize our economic landscape. profoundly changed how most companies operate .

But have you ever encountered a tech CEO who? doesn't Are you suggesting that companies claim they are transforming the globe? Fortunately, this optimistic view about artificial intelligence isn’t confined just to high-ranking executives at tech firms in Silicon Valley. Both investors and stakeholders may find reassurance knowing that entities like the International Monetary Fund and the United Nations have publicly stated their belief in AI’s significant influence.

Start Your Mornings Smarter! Wake up with Breakfast news In your inbox each trading day. Register Now for Free »

Nvidia is capitalizing on the AI trend.

The key driver behind this AI boom is the highly potent chips required by these technologies. So when you inquire with ChatGPT about crafting the perfect roasted chicken (a dash of baking powder combined with salt ensures incredibly crisp skin), swarms of graphics processing units (GPUs) kick into action somewhere out of sight. many -a football-field-sized data center located in some rural area of America. I assure you, this is no joke. Meta Platforms is constructing one in Louisiana, where you could place 70 As expected, filling such a space requires companies to buy numerous GPUs.

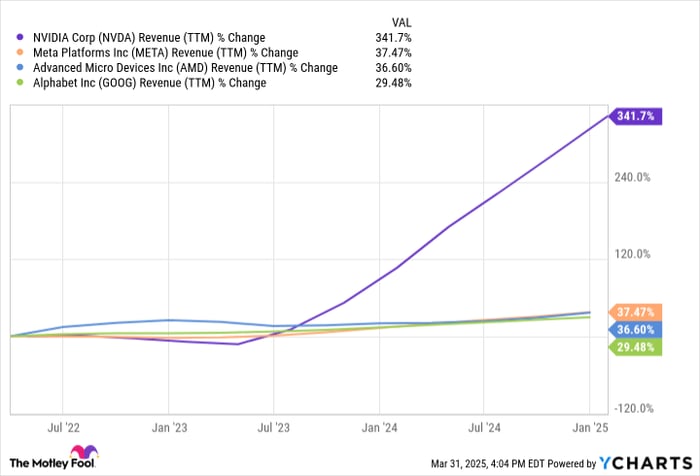

Without a doubt, No business completely dominates the AI GPU market. like Nvidia (NASDAQ: NVDA) And it has been generously rewarded for this. Primarily due to the sales of these chips, the company experienced a dramatic increase in revenue starting from 2023. Review the graph illustrating the sales growth relative to Meta (a key client). Advanced Micro Devices (a rival chipmaker), and Alphabet (which depends on artificial intelligence to enhance its Google search engine, along with products like Waymo, Nest, and YouTube).

Its expansion has been tremendous. During this timeframe, Nvidia significantly increased its profit margins while continuously pushing boundaries to maintain a strong lead over competitors. Indeed, no firm can match it in manufacturing top-tier processors. With the financial capability to heavily invest more than its counterparts in R&D and an appealing environment for attracting and keeping premier talents, it appears improbable that this scenario will shift anytime soon.

CUDA is key

Much focus is placed on Nvidia’s superiority in sheer performance, but arguably its most significant and lasting benefit lies in its CUDA platform. Consider CUDA akin to a programming language enabling developers to leverage GPUs for tasks beyond their initial purpose of rendering graphics.

CUDA serves as the foundational software upon which the intricate structure of artificial intelligence is constructed. Most advanced development platforms and tools utilized by AI developers are designed to be compatible with CUDA.

This indicates that if a client decided to migrate to a competitor’s chips, they would have to dedicate substantial resources and effort to revamp their complete processes and teams—either via extensive reeducation or by laying off current employees and recruiting new ones skilled in alternative technologies. Although such a transition might be technically feasible, the expense involved typically renders it unfeasible for the majority of businesses. As a result, CUDA ensures that Nvidia retains its customers within its technology sphere, even at an additional cost.

The road ahead isn't an easy one.

Even with Nvidia’s leading position, several obstacles remain on the horizon. In the short term, I do not anticipate significant barriers that Nvidia would struggle to overcome. The indicators suggest that the firm will maintain strong sales performance throughout the coming year. Its key large technology clients have pledged unprecedented levels of investment specifically aimed at artificial intelligence initiatives, much of this funding intended for expanding their data centers.

Over the long run, several significant issues emerge. Primarily, artificial intelligence needs to start generating returns substantial enough to validate the enormous investments directed towards its advancement. Merely promising great things won’t suffice indefinitely; investors like those at Alphabet and Meta will become progressively anxious about continued expenditures without evident rewards. Should these profits not materialize over the coming couple of years, funding might well diminish.

Secondly, although Nvidia seems poised to retain its advantage for the near term, technology is an area known for upheaval. A newcomer semiconductor company employing groundbreaking innovations might suddenly rise to prominence. Alternatively, without such fanfare, some of its key customers may create their own chips and transition away from Nvidia despite the protective barrier posed by CUDA that was previously mentioned.

Finally, One of Nvidia's greatest hurdles now comes from its own achievements. At least when it comes to its stock price, the company released another impressive earnings report last month, showing almost an 80% increase in sales compared to the previous year. However, Nvidia’s share value has dropped by 21% within the past six weeks. While broader economic conditions may be contributing negatively, the main issue seems to be that the market demands flawless performance from the company, which is unattainable — except perhaps according to my fifth-grade violin instructor who believes otherwise, though achieving such standards was beyond me.

Nevertheless, only a handful of businesses have shown the foresight that Nvidia possesses. Nvidia should be capable of adjusting to future obstacles. While things certainly won’t always go smoothly, I believe that as time progresses, people’s demands for flawlessness will diminish, allowing Nvidia’s profits to expand significantly. Moreover, since the company’s stock value recently dropped, leading to one of its lowest P/E ratios in several years—well prior to the surge in artificial intelligence interest—I consider investing in Nvidia to be quite astute.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on investing in the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for significant growth. Should you fear missing out on potential gains, this might be an ideal moment to purchase shares prior to their inevitable rise. The statistics clearly indicate this trend:

- Nvidia: If you had put in $1,000 when we increased our investment in 2009, you’d have $281,057 !*

- Apple: If you had invested $1,000 when we increased our stake in 2008, you’d have $42,114 !*

- Netflix: If you had put in $1,000 when we increased our investment in 2004, you’d have $502,905 !*

Currently, we're sending out "Double Down" alerts for three amazing companies, and such an opportunity might not come around again anytime soon.

Continue »

*Stock Advisor returns as of April 1, 2025

Suzanne Frey, who holds an executive position at Alphabet, serves on The Motley Fool’s board of directors. Additionally, Randi Zuckerberg, previously responsible for market development and as a spokesperson for Facebook, and being the sibling of Meta Platforms CEO Mark Zuckerberg, also sits on The Motley Fool's board of directors. Johnny Rice does not hold any shares in the companies listed above. However, The Motley Fool has investments in and endorses Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. They also have a disclosure policy .