It’s likely you’ve come across the saying, “Nothing lasts forever.” This holds up for most facets of life. However, when it comes to investing, this statement isn’t entirely precise, though it’s pretty spot-on. Should there be an eternal option in investments, it would probably be an index fund. Given how unpredictable individual companies can be, index funds stand out because they mirror baskets of stocks selected from the larger market.

One potential timeless index fund you could purchase and retain it indefinitely is the concept Vanguard S&P 500 ETF (NYSEMKT: VOO) This ETF is my top choice for an index fund to get exposure to the market. S&P 500 index , potentially the most remarkable market index globally.

Start Your Mornings Smarter! Wake up with Breakfast news In your inbox each trading day. Sign Up for Free »

Below are five arguments for why the Vanguard S&P 500 ETF ought to have a permanent place in your investment portfolio.

1. This provides a simple method for achieving portfolio diversity.

One of the key aspects of responsible investing is diversification. Have you been advised against putting all your eggs in one basket?

The concept remains similar when dealing with an index fund. Despite doing thorough research, unforeseen issues may arise concerning businesses that even experts couldn’t anticipate. By diversifying your funds among different investment options, you safeguard against significant losses from a single error or unfortunate turn of events affecting your overall financial profile.

The Vanguard S&P 500 ETF mirrors the performance of the S&P 500, which represents 500 leading U.S. corporations. Essentially, each share gives you ownership of small portions across these numerous firms. Investing in such an S&P 500 index fund is among the simplest methods for spreading out investments within your portfolio.

2. It provides access to the S&P 500 index.

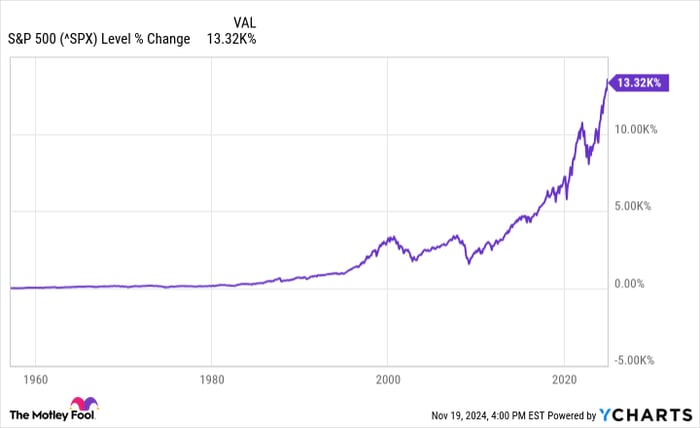

If there's an index you want to follow, it's the S&P 500. Since expanding to 500 companies in 1957, it has created staggering wealth for investors:

The approach is straightforward yet efficient. A panel chooses from leading U.S. firms that meet particular requirements.

The index is adjusted based on market cap, Therefore, a business that flourishes and expands will receive greater importance. By doing this, it basically favors successful stocks. Should a corporation underperform, it might be removed from the index and substituted with another one.

It has functioned exceptionally well that most professional investors underperform The S&P 500 over an extended period.

3. It has minimal fees.

The great aspect of the Vanguard S&P 500 ETF is that owning it comes with minimal expenses. Most exchange-traded funds have fees attached. expense ratio , a charge for managing the fund. The Vanguard S&P 500 ETF has an expense ratio of merely 0.03%. This implies you would pay $0.30 each year for every $1,000 invested.

The fund’s minimal fees stand out as a clever advantage. Fee structures may differ, yet typically, the greater the management activity of a fund, the steeper the costs. While in many aspects you usually receive value proportional to your spending, this isn’t necessarily true when it comes to investment funds. Exorbitant charges do not ensure superior performance (as most experts underperform compared to the S&P 500 index).

Paradoxically, high fees might cause greater damage compared to benefits over an extended period as they accumulate. Keep in mind: These fees are calculated according to your overall investment sum rather than your profits.

4. Trustworthy is Vanguard

You can trust Vanguard with your investments as they have an extensive track record dating back to the 1970s. Currently, their asset base exceeds $9 trillion. They lead globally as both the biggest mutual fund provider and the second-largest exchange-traded fund firm after BlackRock. BlackRock .

Significantly, individuals who invest in Vanguard funds actually become owners of the company rather than owning shares directly in specific companies within the fund. Because the very same people funding these Vanguard funds also own the company, this alignment fosters shared goals and minimizes potential conflicts. Given its scale and organizational design, the firm’s stature ought to encourage investors to adopt a long-term holding strategy.

5. This machine compounds effectively, making it excellent for various investment strategies.

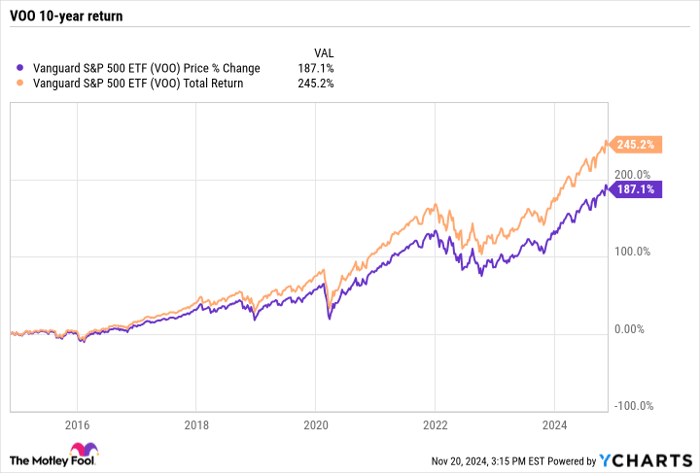

Finally, the S&P 500 provides a diversified mix of assets, making the Vanguard S&P 500 ETF suitable for nearly every investment portfolio. As you've observed, this index has shown remarkable growth over time. Interested in dividends? It distributes one with a current yield of about 1.3%. Overall, the S&P 500 has traditionally provided substantial total returns. roughly 8% annual returns .

Should you put money into the S&P 500 and past patterns continue, your money will double roughly every nine years. Thus, $10,000 grows to become $160,000 within 36 years, highlighting the significant effect of compound interest when it has sufficient time to operate effectively.

No matter if you're a beginner starting out or a retiree aiming to extend your savings, the Vanguard S&P 500 ETF should consider having a place within your investments. This might very well turn into the most advantageous long-term bet you could possibly make with every single dollar.

Is it wise to put $1,000 into the Vanguard S&P 500 ETF at this moment?

Before purchasing shares of Vanguard S&P 500 ETF, keep these points in mind:

The Motley Fool Stock Advisor The analyst team has just pinpointed what they think could be the 10 best stocks For investors looking to purchase now... Vanguard S&P 500 ETF was not among the selections. Instead, the 10 stocks chosen have the potential to deliver substantial gains over the next few years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $894,029 !*

Stock Advisor offers investors a straightforward guide to achieving success, featuring instructions on constructing a portfolio, periodic insights provided by analysts, and the addition of two fresh stock recommendations every month. Stock Advisor service has more than quadrupled the recovery of the S&P 500 index since 2002*

Check out the 10 stocks here »

*Stock Advisor returns as of November 18, 2024

Justin Pope has no holdings in any of the aforementioned stocks. However, The Motley Fool holds positions in and endorses the Vanguard S&P 500 ETF. Additionally, The Motley Fool discloses that they have a disclosure policy .